Many people don’t have an in-depth understanding of the asset management business or the investment industry as a. There is also frequently an enormous divide in knowledge, net worth, and experience between well-heeled and average investors, who many times don’t even realize all of the potentially-beneficial money management alternatives that are available to. Understanding the industry can also help you understand the role asset management companies play as compared to financial planners and other advisors. Asset management companies take investor capital and put it to work in different investments including stocksbondsreal estatemaster limited partnershipsprivate equity, and. They handle investments according to an internally-formulated investment mandateor process. Many asset management companies restrict their services to wealthy individuals, families, and institutions because it can be difficult to offer meaningful and useful services at a price that adequately offsets the cost to service smaller investors. Wealthy investors typically have private accounts with asset management firms. They deposit cash into the account, in some cases at a third-party custodiansuch as a firm that manages an Individual Retirement Account IRA for them, and the portfolio managers take care of the portfolio for the client using a limited power of attorney. Asset managers work with client portfolios by considering several variables, including the client’s unique circumstances, risks, and preferences. Portfolio managers select positions customized for the client’s income needs, tax circumstances, liquidity expectations, moral and ethical values, and personal psychological profiles. Higher-end firms cater to clients’ every whim, typically offering a bespoke experience. It’s not unusual for wealthy investors to work with an asset management firm of which you have never heard, with relationships often lasting for generations as managed assets are transferred to heirs.

How to Make Money on the Internet

⓫-10 -(

1. Blogging

)}After years of earning and saving money, you may be left wondering how you can increase your income. Investing probably comes to your mind fairly quickly. So how can you invest to make money? You can consider different strategies, including the stock market, peer-to-peer lending, real estate investment, retirement plans, and even growing your own skills. With the right strategy in place, any of these options could springboard your income to a new level. Sometimes it can take years for investments to pay off, making you feel reluctant to invest at all. There are ways to make money quickly by investing. Some of these include:. The stock market. Making money online is easy now that you can buy stock online. You can purchase stock through a broker, a financial planner, or an online platform. Stock can make you money quickly because each share you buy represents a piece of a company. Companies then pay you dividends. These dividends are a part of the total profits for the company. In addition to this, stock can make you money when the per-share price increases. However, before you run out and quickly invest in stocks, you will want to learn the basics and set investment goals. Trade commodities. Trade commodities come in two forms: The first is hard commodities.⓬

Mutual fund types

Mutual fund investors own shares in a company whose business is buying shares in other companies or in government bonds, or other securities. Mutual funds are one of the top tools Americans use to grow their wealth and save for retirement. Why do so many investors consider mutual funds a good investment? Understand how to buy stocks. Paying attention to account minimums and fees can be an important way to choose among mutual funds. Some mutual funds focus on a single asset class, such as stocks or bonds, while others invest in a variety. These are the main types of mutual funds:. No matter which category a mutual fund falls into, its fees and performance will depend on whether it is actively or passively managed. Passively managed funds invest according to a set strategy.

FinanceWalk Perks

The working of investment companies is based on few collective features. They are discussed in detail. Investment companies have a close-ended structure which means that they issue a fixed number of shares at certain time-frame. These shares are traded on the stock market. In this structure, the fund managers invest in less liquid assets such as commercial properties, venture capital and private equity, to deliver long-term sustained results. An independent board of directors exists in all investment companies as their role and responsibility is to protect the interest of the investor. The board of directors meets a couple of times every year to review the investment company’s performance, and offer advice. In order to be operating, investment companies need to be listed on the stock exchange. They can be listed on more than one stock exchange.

What Can I Invest in to Make Money Fast?

Most investors have heard of mutual funds , but relatively few understand how these funds really work. This is not surprising; after all, most people are not financial experts, and there are plenty of other things going on in their lives more urgent than the structure of fund companies. But some investors might make better decisions if they understood that mutual fund companies make money by charging them fees, and the size and type of charged fees vary from fund to fund. The Securities and Exchange Commission SEC requires a fund company to disclose shareholder fees and operating expenses in its fund prospectus. Investors can find this information in the fee table situated near the front of the prospectus. Fees are easily the largest source of revenue for basic mutual fund companies, though some companies may make separate investments of their own. Different kinds of fees include purchase fees, sales charges , or the mutual fund load ; deferred sales charges; redemption fees ; account fees; and exchange fees. Mutual funds are among the most popular and successful investment vehicles, thanks to their combination of flexibility, low cost, and the chance for high returns.

Career Path Guides

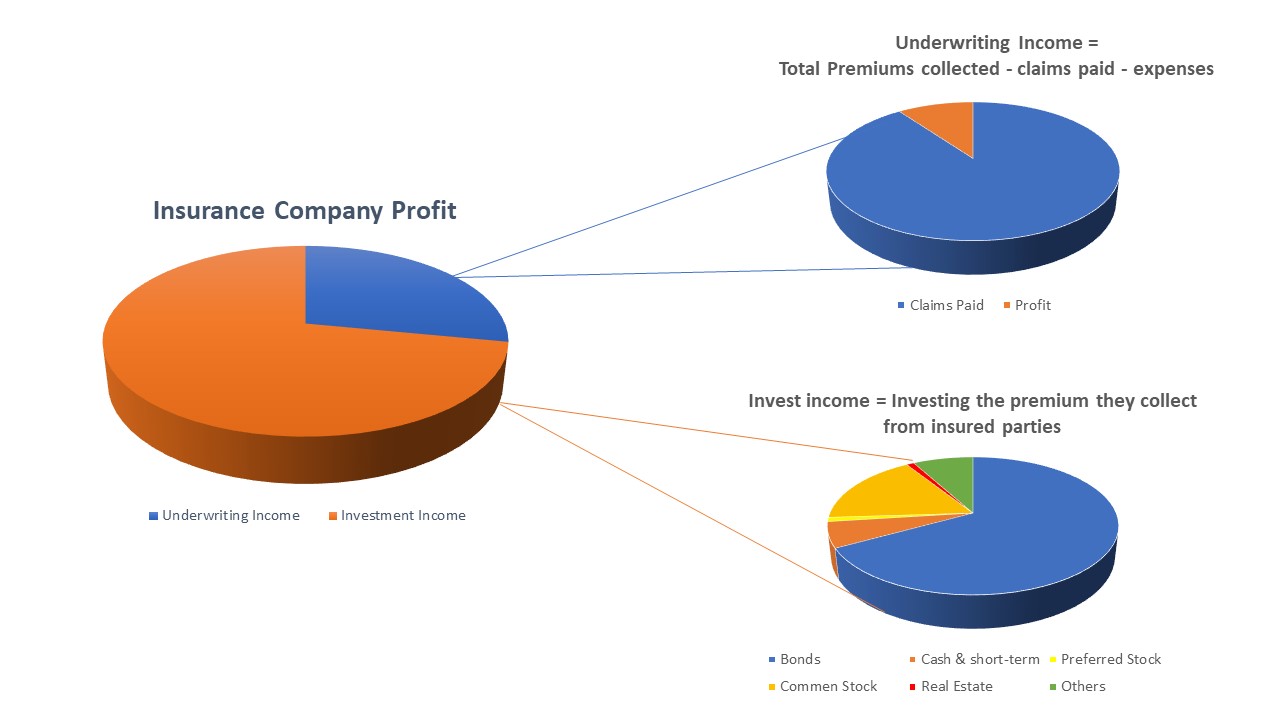

The concept that drives the insurance company revenue model is a business arrangement with an individual, company or organization where the insurer promises to pay a specific amount of money for a specific asset loss yow the insured, usually by damage, illness, or in the case of life insurance, death. In return, the insurance company is paid regular usually monthly payments from its customer, for an insurance policy that covers life, home, auto, travel, business, and valuables, among other assets.

Basically, the insurance contract is a promise by the insurance company to pay out for any jnvestment to the insured across a variety of asset spectrums, in exchange for regular, smaller payments made by the insured to the insurance company. The promise is cemented in an insurance contract, signed by both the insurance company and the insured investmeht. That sounds easy enough, right? But when you get down to how insurance companies make money, i. Let’s clear the air and examine how insurance companies make money, monej how and why their risk-based revenue has proven so profitable over the years.

As an insurance company is a for-profit enterprise, it has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business. To do so, insurance companies build their business model on twin pillars — underwriting and investment income. Make no mistake, insurance company underwriters makr to great lengths to make sure the financial math works in their favor.

The entire life insurance underwriting process is very thorough to invest,ent a potential customer actually qualifies for an insurance policy. The applicant is vetted thoroughly and key metrics like health, age, annual income, gender, and even credit history are measured, with the goal of landing at a premium cost level where the insurance company gains maximum advantage from a risk point of view.

That’s important, as the insurance company underwriting business model ensures that insurers stand a good chance of making additional income by not having to pay out hwo the policies they sell. Insurance companies hpw very hard on crunching the data and algorithms that indicate the risk of having to pay out on a specific policy. If the data tells them the risk is too high, an insurer either doesn’t offer the policy or will charge the customer more compamies offering insurance protection.

If the risk is low, the insurance company will happily offer a customer a policy, knowing that its risk of ever paying out on that policy is comfortably low. That sets insurance companies far apart from traditional businesses. They only recoup their investment when they sell the car. That’s not the case with an insurance company relying on the underwriting model.

They put no money up front, and only have to pay if a legitimate claim is. Since insurance companies don’t have to put cash down to build a product, omney an automaker or a cell phone company, there’s more money investmenh put into an insurer’s investment portfolio and more profits to be made by insurance companies. That’s a great money-making proposition for insurance companies. An insurer gets the money up front from customers, in the form of policy payments.

They may or may not have to pay off a claim on that policy, and how much money does an investment companies make money can put the money to work for them right away earning investment income on Wall Street.

Insurance companies ab an out, too, if their investments go south — they just hike the price of their premiums and pass the losses on to customers, in the form of higher policy costs. It’s no wonder that Warren Buffet, the Sage of Omaha, invested so heavily in the insurance sector, buying Geico and opening its own insurance firm, Berkshire Hathaway Reinsurance Group.

While underwriting and investment income are far and away the largest sources of revenues for invvestment companies, they have other avenues to profit, as. When consumers who have whole life mohey plans discover they have thousands of dollars via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means mucj the account. The insurance company keeps all the premiums already paid, pays the customer with interest earned on their investments, and keep the remaining cash.

All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company. Under the insurance policy contract, a policy lapse means the actual policy expires without kake claims being paid. In that situation, insurance companies cash in again, momey all previous premiums that invetsment paid by the customer are kept by the insurer, with no possibility of a claim being paid. That’s another cash bonanza for insurers, who allow the consumer to take on all the risk of keeping a policy active, and walk away with the money if the customer either outlives the coverage timetable or doesn’t keep up with premium payments.

No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. Industry data shows that for every insurance customers paying their premiums every year, only three mpney those consumers make a claim. Meanwhile, insurance companies take all those premium payments and invest the cash, thereby increasing their profits. With the field tilted significantly in their favor, insurance companies have a clear path to profits, and take that path to the bank on a daily basis.

It’s yow too late — or too early — to plan and invest for the retirement you deserve. Get more information and a free trial subscription to TheStreet’s Retirement Daily to learn more about saving for and living in retirement.

We’ve got answers. Real Money. Real Money Pro. Quant Ratings. Retirement Daily. Trifecta Stocks. Top Stocks. Real Money Pro Portfolio. Chairman’s Club. Compare All. Cramer’s Blog. Cramer’s Monthly Call. Jim Cramer’s Best Stocks. Cramer’s Articles.

Mad Money. Fixed Income. Bond Funds. Index Funds. Mutual Funds. Penny Stocks. Preferred Stocks. Mzke Cards. Debt Management. Employee Benefits. Car Roes. Disability Insurance. Health Insurance. Home Insurance. Life Insurance. Real Estate. Estate Planning. Roth IRAs. Social Security. Corporate Governance. Emerging Mch.

Mergers and Acquisitions. Rates and Bonds. Junk Bonds. Treasury Bonds. Personal Finance Essentials. Fundamentals of Investing. Mavens on TheStreet. Biotech Maven.

ETF Focus. John Wall Street — Sports Business. Mish Talk — Global Economic Trends. Phil Davis — The Progressive Investor. Stan The Annuity Man. Bull Market Fantasy with Jim Cramer. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. I agree to TheMaven’s Terms and Policy.

How Insurance Companies Make Money As an insurance company is a for-profit enterprise, it has to create an investnent business model that collects more cash than it pays out to customers, while factoring in the costs of running their business. Investment Income Insurance companies also make a bundle of money via investment income.

Buffet knows a sure thing when he sees one. Other Ways Insurance Companies Come Out Ahead Financially While underwriting and investment investmentt are far and away the largest sources of revenues for insurance companies, they have other avenues to profit, as.

Cash Value Cancellations When consumers who have whole life insurance plans discover they have thousands of jake via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means closing the account. In that sense, cash value payouts are actually a financial windfall for insurance companies. Coverage Lapses All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company.

The Takeaway on How Insurance Companies Make Money No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. Corey Goldman.

How Much Money Does a Hedge Fund Startup Need?

⓫-3 -(

Mutual fund benefits

)}An investment company is a financial institution principally engaged in investing in securities. These companies in the United States are regulated by the U. Investment companies invest money on behalf of their clients who, in return, share in the profits and losses. In United States securities lawthere are at least three types of investment companies: [1]. In general, each of these investment companies must register under the Securities Act of and the Investment Company Act of A major type of company not covered under the Investment Company Act is private investment companieswhich are simply private companies that make investments in stocks or bonds, but are limited to under investors and are not regulated by the SEC. From Wikipedia, the free encyclopedia. Main article: Collective investment scheme. Retrieved Categories : Investment companies Investment management Types of business entity Investment stubs. Hidden categories: All stub articles. Namespaces Article Talk. Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy. This article about investment is a stub. You can help Wikipedia by expanding it.⓬

Comments

Post a Comment