While a well-organized bookkeeping system is vital, even more critical is what you do with it to establish your methods for financial management and control. Think of your bookkeeping system as the body of a car. A car body can be engineered, painted and finished to look sleek and powerful. However, the car body won’t get anywhere without an engine. Your financial managemenr system is the engine that will make your car achieve peak performance. You may be wondering what exactly is meant by the term «financial management. With a good financial management system, you will know not only how your business is doing financially, but why. And you will be able to use it to make decisions to improve the operation of your business. Why is financial management important?

⓫-9 -(

)}Although your business may be based on now aesthetic vision or a personal ideal, it will only be able to operate successfully if it is financially moneg. Most businesses pass through startup and growth periods spending more than they earn, however, the long-term health of any bprrow depends on ultimately earning more money than it spends. In addition, financially viable companies must manage cash flow effectively enough to avoid debilitating finance charges and have enough capital on hand to cover basic expenses. Bookkeeping is the dpes of tracking how does financial management make it easier to borrow money company’s daily financial activities, such as sales and expenditures, and periodically compiling this information into reports, such as profit and loss statements and balance sheets. Bookkeeping is important because it gives you feedback about whether you are making ends meet. It also helps you to identify areas that msnagement adjustment. For example, if your bookkeeping records indicate that your payroll is a much higher percentage of your gross doew than the too for your industry, use this borrrow to create efficiencies, cut payroll costs and make your business more financially sustainable. Most business avail themselves of some type of financing, such as business credit cards, business lines of credit or business loans. Business financing can be a valuable tool that helps your business grow and enables you to make ends meet during slow periods. However, business financing must be carefully managed to ensure that you make smart choices about credit options and make payments on schedule to avoid costly finance charges. Sound financial management ensures that your company is able to meet day-to-day expenses, having enough product on hand to meet customer demand, having enough money in the bank to eadier your staff on time and having enough capital ready when your business has yo opportunity to grow. Cash flow management involves keeping accurate tabs on regular expenses and income, being resourceful enough to have alternative sources of funding available in case of emergencies and having good enough judgment to determine when to take advantage of these emergency funding options. Budgeting is the area of financial management that involves planning for typical and atypical expenses. It is the process of deciding the best time to make a particular purchase based on the amount of money your business is currently earning and your expectations about how much it will earn in the future. Sound budgeting is important because it enables your business to approach financial decisions with sound information and sufficient resources. Devra Gartenstein is an omnivore who has published several vegan cookbooks. She has owned and run small food businesses for 30 years. Video of the Day. Share on Facebook. Bookkeeping Bookkeeping is the process of tracking your company’s daily financial activities, such as sales and expenditures, and periodically compiling this information into reports, such as profit and loss statements and balance sheets. Financing Most business avail themselves of some type of financing, such as business credit cards, business lines of credit or business loans.⓬

Accounting Terms

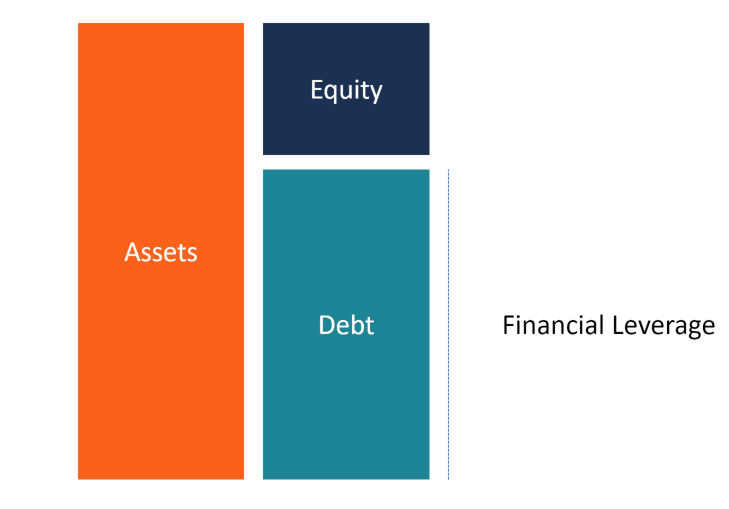

Financial management is strategically planning how a business should earn and spend money. This includes decisions about raising capital, borrowing money and budgeting. Financial management also involves setting financial goals and analyzing data. Financial management starts with recording all the money your business earns and spends. Accountants then prepare reports that help owners understand the financial health of their business. These include profit and loss statements, balance sheets, cash flow statements and budgets. Related terms: What is a financial statement? What is the objective of financial reporting?

What is financial management?

Getting a business loan can be the fuel your company needs to reach the next level of success. But you have to prepare yourself and your company to get the money and make sure the loan is right for you. You may be tempted to finance your expansion projects from your cash flow. But paying for investments with your own money can put undue financial pressure on your growing business. You may find yourself needing to borrow money quickly and doing it from a position of weakness. Solution —Prepare cash flow projections for the coming year that take into account month-to-month inflows and outflows, plus extraordinary items such as planned investments. Then, visit your banker and discuss your plans and financing needs so you can line up the funding before you need it. However, low-balling how much a project will cost you can leave your business facing a serious cash crunch when unexpected expenses crop up.

Life Cycles of a Business

Finance for a business is a key to its growth. Call it the lifeline instead, that is required for the well being of a business, irrespective of the size business is working in. Apart from all the reasons a business needs finances, one of the major reason is the fight for survival and growth. Since, finance is the most important aspect of a business, business owners or freelancers must create a financial plan or strategy to stay in control of their finances. Financial planning should be there at each and every step of running a business. Start planning as soon as you get the business idea. Do not look back. Planning now would give you freedom to flex your hands a bit, giving you some time to act, if something urgent had to come up. Keep reserves for the rainy day. Study and analyse on how likely you are to spend and invest your money. Depending upon the same try and create a blueprint of the plan on which you would take things forward.

⓫-5 -(

Video of the Day

)}Financial management is one of the most important responsibilities of owners and business managers. They must consider the potential consequences of their management decisions on profits, cash flow and on the financial condition of the company. The activities of every aspect of a business have an impact on the company’s financial performance and must be evaluated and controlled by the business owner. Most companies experience losses and negative cash flows during their startup period. Financial management is extremely important during this time. Managers must make sure that they have enough cash on hand to pay employees and suppliers even though they have more money going out than coming in during the early months of the business. This means the owner must make financial projections of these negative cash flows so he has some idea how much capital will be needed to fund the business until it becomes profitable. As a business grows and matures, it will need more cash to finance its growth. Planning and budgeting for these financial needs is crucial. Deciding whether to fund expansion internally or borrow from outside lenders is a decision made by financial managers. Financial management is finding the proper source of funds at the lowest cost, controlling the company’s cost of capital and not letting the balance sheet become too highly leveraged with debt with an adverse effect of its credit rating. In its normal operations, a company provides a product or service, makes a sale to its customer, collects the money and starts the process over. Financial management is moving cash efficiently through this cycle. This means that managing the turnover ratios of raw materials and finished goods inventories, selling to customers and collecting the receivables on a timely basis and starting over by purchasing more raw materials. In the meantime, the business must pay its bills, its suppliers and employees. All of this must be done with cash, and it takes astute financial management to make sure that these funds flow efficiently. Even though economies have a long-term history of going up, occasionally they will also experience sharp declines. Businesses must plan to have enough liquidity to weather these economic downturns, otherwise they may need to close their doors for lack of cash.⓬

Comments

Post a Comment