Lending Club has been transforming the banking system because of their peer-to-peer lending model that makes those exact promises. And they offer a multitude of loan products, from personal to medical to business — many collateral-free. In fact, you can get average returns of between 5. Plus, there are certain requirements you have to meet as an investor. Remember, the higher the potential reward, the higher the risk. Open an account. Notes are not available in all states. As of this writing, they are not available to residents of New Mexico, North Carolina and Pennsylvania.

Latest on Entrepreneur

⓫-12 -(

What is Lending Club?

)}LendingClub has become one of the more reputable destinations for online personal loans, usually an ideal method to borrow for a special need or credit card debt consolidation. It helped to originate peer-to-peer marketplace lending, which matches borrowers with investors who are willing to fund the loans. LendingClub is best suited to serve borrowers with responsible payment records and established financial histories. The typical LendingClub client has a good credit score and a lengthy credit history an average of 17 years. The purpose of these loans has been refinancing a home The risk: Investors — not LendingClub — make the final decision whether or not to lend the money. That decision is based on the LendingClub grade, utilizing credit and income data, assigned to every approved borrower. That data, known only to the investors, also helps determine the range of interest rates offered to the borrower. Once approved, your loan amount will arrive at your bank account in about one week. Borrowers can file a joint application, which could lead to a larger loan line because of multiple incomes. That would bring a high interest rate and steep origination fee, meaning you could probably do better with a different type of loan. It will allow you to conveniently shop around without hurting your credit score. Of course, the interest rate might not be ideal with that score, but it might be a good deal for borrowers with so-so credit who usually have to settle for subprime offers. LendingClub money usually requires about a seven-day period to become available. There are other places that could turn the clu around in a day. Origination Fee: After determining inveating credit risk, LendingClub will provide an interest rate, but part of that is an origination fee, which will cut into your loan. Other Fees: There are an assortment of other fees. A minimum credit score of is required, along with a minimum credit investint of three years. Upon approval, you can on an online calculator with individual options, including the fixed monthly payment for a month loan and a month loan with the interest how to make money investing in lending club for each option. If you are turned down by LendingClub or only qualify for a high-interest loanyou have options. First, make sure all the information presented to LendingClub was correct.⓬

What are the Risks?

Some investors have seen even greater returns. However, peer to peer lending can be risky because you are lending money to strangers online — and that’s where the platform comes in. You want to ensure you can do your due diligence before lending anything to anyone. Is LendingClub investing for you? Check out Lending Club here. LendingClub is one of the first online Peer to Peer lending platforms. Today, LendingClub and other P2P lenders streamline the process. He can apply for the loan online, and LendingClub investors can fund the loan. Peer to peer lending allows individuals to invest in consumer credit.

How I Ended Up Doing The Online Business Thing https://t.co/qAY5ihR5GW pic.twitter.com/dV35UqQV8k

— Dia Darling (@Diadoll) January 27, 2020

Lending Club Review

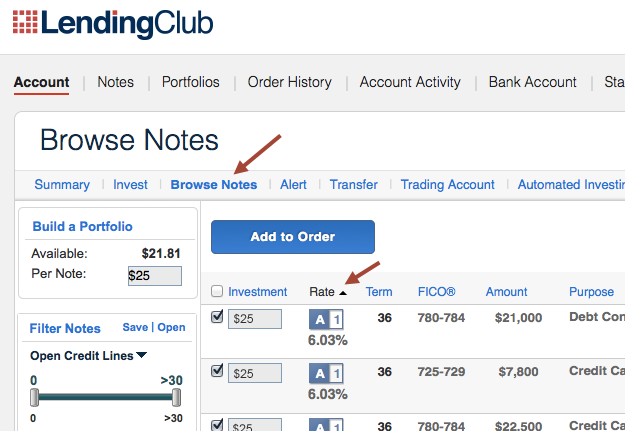

If you open an account through one of these links the blog will receive a small commission from Lending Club. This review was last updated in June, Why have they been so successful? They provide excellent returns for investors and they allow quick access to funds at competitive interest rates for borrowers. Some investors read about Lending Club and dive right in. But the intelligent investor does some research. This article will provide all the information a new investor needs to get started. To help you get familiar with the Lending Club platform I have recorded a short video. This video provides an introduction to the Lending Club interface and shows you how to invest in these p2p loans. Before you begin, though, you need to consider if you are eligible to invest. To invest at Lending Club you need to meet a number of requirements:. Every investor should consider the risks of an investment before committing their money. Investing with p2p lending has a number of risks:.

How It Works

A major share of a compan like Bank of America come from mortgages and credit cards — loans to individual people. The rates that most of these loans go for are pretty solid and always based upon fixed payments. Guess what, now you can get in on the gravy train too and this particular gravy train is called Lending Club.

Simply put, Lending Club is a peer to peer lending service. That means, instead of going to a bank for monry loan, you can get a loan from a group of random people. Borrowers use Lending Club because they get better rates then they would with a bank loan and loans are issued much faster through the power of the crowd.

The crowd will also approve loans that normally banks may not. Personally my investment focus is on Small Business loans as the returns are excellent and they are often made by people willing to work hard — something I always invest in. That means they can significantly reduce the risk of any single loan. There are also mountains of statistics at their disposal to help build the strongest portfolios possible. They have a vested interest in leneing being more successful here than other investment opportunities.

Lending Club functions similar to a mortgage company in that they help broker deals for amortized loans. Amortized loans are just loans that are front loaded with interest payments and are structured such that overpayment simply reduces the overall term of the loan, not the monthly payments. Loans like this are stacked in the lenders favor as the lender will receive a higher portion of interest earlier in the loan allowing the lender to not really care too much if the borrower pays the loan off early.

The one invessting difference between Lending Club and a mortgage company is that Lending Club contributes no money toward funding loans. All loans are funded by people like me or you.

The primary objective of Lending Club is to make sure all loans are accurately classified in terms of risk. What happens is, when I invest in a loan Lending Club holds that money in escrow until they officially fund the loan. In this limbo period, Lending Club is investigating all of the information entered by the potential borrower for accuracy. As a borrower you will have to make monthly payments to Lending Club much like you do with your mortgage. This can be automated just like your mortgage — through a linked bank account.

You can also overpay your loan with no penalties allowing you to end your loan at any time. You link your bank account, transfer the funds over to your personal Lending Club account and then begin investing.

As for the details of how to invest, picking the best loans, etc. Beyond investing, the only thing you need to makke concerned about is payment.

Lending club details all of this for you so you know exactly how much income to expect and. The beauty of the treasure lsnding of data which Lending Club makes available is it allows you to have realistic expectations around the entire process, as a lender or a borrower. Based on the data I saw it seems nearly all loans get funded within 24 hours and become active within 7 days. Having a loan become active just means inevsting the money you invested which starts off in escrow with Lending Club gets sent to the borrower and the loan term begins.

There are koney ton of different strategies to investing with Lending Club. Below are the details of how I pick an investment in Lending Club. And by income I mean cold hard cash that I can withdraw and spend or invest in other new loans. Based at no more than 5 minutes at the summaries on their data portal we we can tell that the highest portfolios: Are Grade E with an interest rate of Have higher return rates the more money you invest.

Now we could just blindly pick all loans that match these categories or we could be more thoughtful and try to add a few more restrictions. Worst case, if a loan does go sour, I can always try and sell it before it goes completely bad. That begs the question, who is the type of person we want to lend to? This is an example loan that I invested in right before I wrote this article I always reinvest loan income.

Look at that Revolving Credit Balance! How could this be? Figure the guy or girl got their first credit card as soon as they turned 18 like most of us did then that means if their first credit line was in they must be Also, they are opening up a small business loan.

In fact, some of the best lenfing I invest in are for Credit Card Refinancing. This is an example of what I invest in — not always according do the core rules and definitely skewed towards higher interest loans.

I figure this may tell me a few interesting things over time and since it takes only an extra minute with each order, I decided to set it up. So, will this all lwnding out? Right now my Net Annualized Return is Are you thinking about using Lending Club? Do you use it right now? Let us know in the comments! Listen Money Matters is reader-supported. When you buy through links on our site, we may earn an affiliate commission. How we make money. Simply Put: Lending Club is a peer-to-peer online marketplace that matches lenders with mke.

By providing investors with the ability to purchase consumer debt, Lending Club can offer better rates for borrowers as well as a high rate of return for investors. In this review. Read These Next. Get our best strategies, tools, and support sent straight to your inbox. Sign Up, It’s Free.

Why You Should Not Invest in Peer to Peer Lending — BeatTheBush

What to Expect When You Invest with Lending Club

⓫-3 -(

Why P2P Lending?

)}A major share of a compan like Bank of America come from mortgages and credit cards — loans to individual people. The rates that most of these loans go for are pretty solid and always based upon fixed payments. Guess what, now you can get in on the gravy train too and this particular gravy train is called Lending Club. Simply put, Lending Club is a peer to peer lending service. That means, instead of going to a bank for a loan, you can get a loan from a group of random people. Borrowers use Lending Club because they get better rates then they would with a bank loan and loans are issued much faster through the power of the crowd. The crowd will also approve loans that normally banks may not. Personally my investment focus is on Small Business loans as the returns are excellent and they are often made by people willing to work hard — something I always invest in. That means they can significantly reduce the risk of any single loan. There are also mountains of statistics at their disposal to help build the strongest portfolios possible. They have a vested interest in lenders being more successful here than other investment opportunities. Lending Club functions similar to a mortgage company in that they help broker deals for amortized loans. Amortized loans are just loans that are front loaded with interest payments and are structured such that overpayment simply reduces the overall term of the loan, not the monthly payments.⓬

Comments

Post a Comment