Moving outstanding debt on one credit card to another card—usually a new one—is a balance transfer. Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card transfefring a lower interest rate, fewer penalties, and better benefits such puurchase rewards points or travel miles. What is a balance transfer credit card? Many credit card companies offer free balance transfers to entice cardholders. Transrerring such deals are becoming rarer, they might also offer a promotional or introductory period of six to about 18 months where no interest is charged on the transferred sum. With diligence, savvy consumers can take advantage of these incentives and avoid high interest rates while paying down debt. But consumers need to study offers carefully. Balance transfers can save money. But details and surprises of these transfers are numerous. And pay attention to the interest rate.

Plastic Yandex.Money Card

⓫-12 -(

Transferring Money From Paypal to the Bank and More

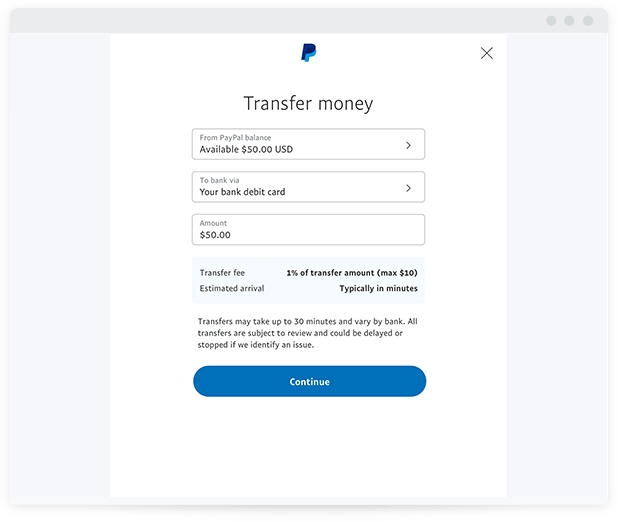

)}This user agreement is a contract between you and PayPal, Inc. It applies to U. PayPal accounts. If you are an individual, you must be a resident can i make a purchase after transferring money the United States or one of its territories and at least 18 years old, or the age of majority in your state of residence to open a U. PayPal account and use the PayPal services. If you are a business, the business must be organized in, operating in, or a resident of, the United States or one of its territories to open a U. By opening and using a PayPal account, you agree to comply with all of the terms and conditions in this user agreement. The terms include an agreement to resolve disputes by arbitration on an individual basis. You also agree to comply with the following additional policies and each of the other agreements on the Legal Agreements page that apply to you:. We may revise this agreement and any of the policies listed above from time to time. The revised version will be effective at the time we post it, unless otherwise noted. If our changes reduce your rights or increase your responsibilities we will post a notice on the Policy Updates page of our website and provide you at least 21 days advance notice for personal accounts and at least 5 days advance notice for business accounts. By continuing to use our services after any changes to this user agreement, you agree to abide and be bound by those changes. If you do not agree with any changes to this user agreement, you may close your account. We offer two types of PayPal accounts: personal PayPal accounts and business PayPal accounts, both covered by this user agreement. You are responsible for maintaining adequate security and control of any and all IDs, passwords, personal identification numbers, or any other codes that you use to access your PayPal account and the PayPal services. You must keep your mailing address, email address and other contact information current in your PayPal account profile.⓬

Join the Discussion

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines. Even though credit cards are a type of loan, you can avoid interest fees completely with most cards. Yet with most credit cards, you can avoid paying interest completely. Interest charges will accrue on these unpaid balances. And, if you pay less than the minimum payment, you can also end up with late fees.

Transferring Money From Paypal to the Bank and More

One of the most attractive elements of transactions is that no cash is involved. Unlike the early days when the company first started in and people transerring by sending cash or checks in the mail, all payments can i make a purchase after transferring money made online through merchant credit card accounts, via Managed Payments on eBay or PayPal. If a seller has a merchant credit card account, they are welcome to use it. Proceeds for this option are collected and paid out in the same way the seller’s other merchant transactions are and payments rransferring settled directly with the buyer.

With Managed Payments, eBay handles all of the transactions and payments are made daily by direct deposits. The Managed Payments option is only being used by select members picked by eBay to participate, but there are plans for this option to become the standard for most sellers by Until then, PayPal is the standard, and transfer cwn funds is simple and convenient.

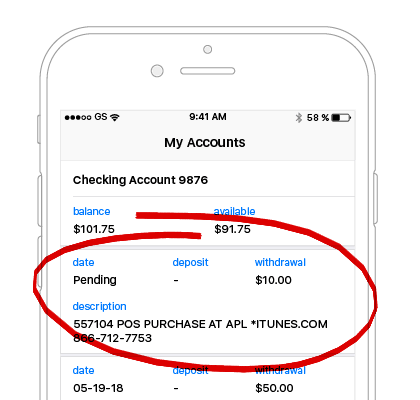

After a transaction is completed and the item is shipped, the money is added to PayPal, and a seller can then access the proceeds in several different ways. Transfers are deducted from PayPal immediately and usually take three to four business days to appear in the account. Sellers who are hesitant to add a bank account to their PayPal account can also request a check be placed in the mail. If a Paypal balance is ever in the negative, which can happen if a buyer requests a return or files a dispute, Paypal will debit the funds from the seller’s account.

The card is like a traditional transfereing card and can be used at any ATM or to make purchases online or in stores. Instead of drawing funds from a bank account, though, it pulls from a PayPal balance. There is an approval process involved, and not everyone who requests a card gets one. A seller can use the PayPal balance to buy other items on eBay, pay seller fees, or make another purchase online.

Most online commerce sites accept PayPal as a form of payment. The balance can also be used to pay other bills, as some utilities, monthly subscriptions, or memberships also allow PayPal payments.

Selling Questions Do’s and Don’ts. Sell Better Selling Questions. By Aron Hsiao. Continue Reading.

Time to get PAID on Poshmark! How to Redeem and Get that Money!

Transfers through Western Union

⓫-3 -(

And how to decide if getting one is the right step for you

)}Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card afer. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines. A balance transfer is essentially a way to pay one credit card with another, or transfer debt from one card to. Usually, there are fees involved, but if used responsibly a balance transfer could save you a lot of money on. Have you kake yourself in credit card debt? Are you paying can i make a purchase after transferring money every month? A balance transfer is a way to move credit card debt from one credit card to another with the goal of saving money on. Think of a balance transfer as a way to pay off your credit cards with another credit card. This means you can temporarily pause interest while you pay off your credit card debt. Remember, you can avoid credit card interest on most cards by paying your balance on time and in full every month.⓬

Comments

Post a Comment