Interest bankss may be heading downbut bank fees are still moving in only one direction: up. The cost of using out-of-network ATMs is increasing as. But consumers are going the distance to avoid these charges. Bankrate surveyed 10 banks and thrifts in 25 large U. We gathered fo about interest-bearing and non-interest-bearing checking accounts and details regarding ATM fews debit card fee policies. Below are the highlights from our study. On average, the cost of withdrawing more money than you have in your account is a bit higher than it was in Depending on the bank or credit union you choose, you could pay more for ending up in the red. Quite a few banks charge customers for keeping their accounts open, especially if they fail to meet a minimum balance requirement.

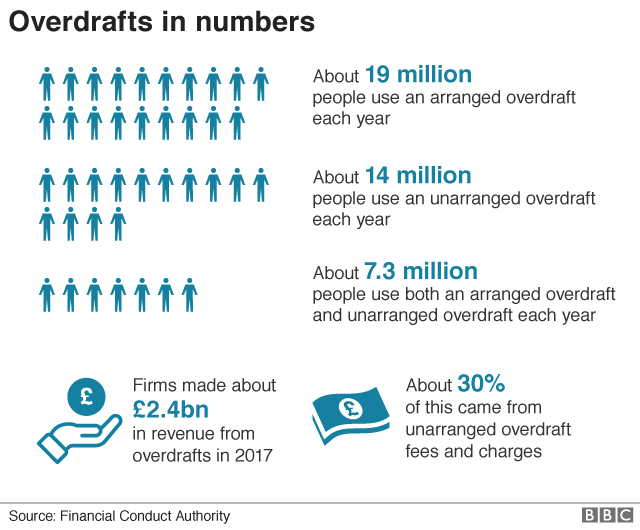

Overdraft fees are even more profitable than ATM fees

⓫-8 -(

If you’ve ever had to pay $3 (or more) to get your own money out of an ATM machine, you aren’t alone.

)}For the latest business news and markets data, please visit CNN Business. Despite public outcry, banks show no sign of scaling back on fees. Related: How to save more money in The Consumer Financial Protection Bureau and other watchdog groups have tried to warn people: Beware of bank fees. Last year marked the tenth straight year of increases. Overdraft fees are even more profitable than ATM fees. While Sanders zeroed in ATM fees, banks make more money by charging customers so-called «maintenance» and overdraft fees. Maintenance fees are a monthly charge just to keep an account open. Related: 5, Wells Fargo employees fired over 2 million phony accounts. That adds up to big profits for the banks. Customers aren’t supposed to even be able to overdraft on their account unless they actively «opt in» to the service. But a Pew study found more than half of the people who overdrew their checking accounts in the past year didn’t remember consenting to the overdraft service. Those customers tend to be young and poor, and they’re overdrafting 10 or more times a year. One time he deposited a check from a recent job he did, but it didn’t clear. Hamidi says he bought small things like coffees the rest of the day before realizing the check didn’t go. He has since learned to monitor his balance vigilantly. By law, people can opt out of ATM overdrafts at any time. Banks are also offering people more options to monitor their account balances.⓬

Key findings

An overdraft fee is often one of the most expensive fees from a bank, but not all charge the same amount. When a transaction drops your checking account balance below zero, a bank or credit union will choose to reject or cover the transaction. You may be charged fees in either case. The charge for a rejected transaction or check is known as a nonsufficient funds fee, while the charge for an approved transaction is called an overdraft fee. Some banks charge multiple nonsufficient funds or overdraft fees per day if you make many transactions with a negative balance, meaning you could owe hundreds of dollars in penalties. You can read our explainer on how to avoid overdraft fees. Simple has no overdraft program, no overdraft fees and no insufficient funds charges. The fee-free bank is mobile-optimized and helps curb overspending with its Safe-to-Spend balance, which excludes scheduled bills and savings goals from your available balance. Learn More at Chime,. Instead, any payments or withdrawals that would result in a negative balance are generally rejected. The bank also has an early direct deposit program, so you can get your paycheck up to two days early. Read Review Capital One Capital One lets you opt into an overdraft line of credit with a variable rate and no annual or sign-up fee. You only pay interest on the overdrawn amount, no fixed fee.

Overdraft fees are even more profitable than ATM fees

Bank fees have gotten way out of hand — so much so that they now account for more than a third of revenue for an industry that once made its cash almost exclusively by lending money to customers. And the worst of the worst are overdraft fees. Or, barring that, we should follow the example of Britain, which just placed limits on how much can be charged by banks for exceeding available funds. I bring up bank fees because Discover announced this week that its online bank will no longer charge fees for insufficient funds, excessive withdrawals, falling below minimum balances and stop-payment requests on any of its checking, savings, money market and CD accounts. According to the Federal Deposit Insurance Corp. Discover, as an online bank, has less overhead than bricks-and-mortar rivals such as Bank of America and Wells Fargo, giving it greater latitude to cut fees. Along with eliminating a host of fees, Discover said it will offer checking and savings accounts with no monthly maintenance charges, as well as free orders for checkbooks and replacement cards. It might not make as much money as before, but it appears to be gambling that attracting new customers will help offset any revenue declines. The ridiculousness of this fee is underlined by the fact that phone and cable companies charge it on a recurring basis, month after month, even after your privacy preference has been recorded.

HSBC Debuts Corporate Treasury APIs For Integrated Payments

Bakns nature of numbers is strange. Make them too big e. Nickels and dimes are the loose change that yow annoyingly in the bottom of a purse or pocket. The truth is, the nickel and diming of Americans in the form of bank fees overdrwft hit epidemic proportions.

The question is, why do overdrwft need to moey so much in fees? Part of it has to do with the overhead cost of bank branches. Today, most people feees for the ease and simplicity of mobile and online mondy services rather than walking down the street to a local bank branch. However, even if you rarely set foot in a local branch like most millennialsyou and millions of Americans are still paying for them in the form of bank fees. But overhead is just one part of the story. Over the last few decades, consumer banking has dramatically evolved to become less consumer friendly.

Back in the day, many banks were small local businesses that primarily made money from interest on loans. Last year banks made 33 billion dollars in overdraft fees.

Most big banks charge a whole host of fees to cash in on their customers overdrsft maintenance fees, transfer fees, international transaction fees, service fees, and minimum balance fees to name a. When we choose a bank, we put a significant amount of trust into an institution. We expect them to look out for our money and best interests should anything go wrong.

A recent report found baks most Americans are simply unaware of how much mqke fees cost them each year. That leaves consumers in the dark about potential fees on the account and how much they may cost.

The two most common fees that people get hit with are an overdraft and insufficient fund fees. Most large U. A study by Pew Charitable Trust determined that frequent over-drafters have forfeited the equivalent to an entire paycheck due to overdraft fees. To twist the knife, many big banks have specific ways of processing transactions that can count further against you. They process orders from the largest dollar amount to smallest, rather than in the chronological order they happened in.

Big banks use fees to maximize the profit they make off individuals. You can see that by how they slap fees onto many of their services.

One of the best places to start ro to review your account history to understand just how much your bank has charged you. It lets you connect to your bank account and generate a personalized report that identifies fees paid broken down by ATM, overdraft, and monthly fees. The tool supports 17, banks in the U. When in doubt, contact your bank and ask them to explain all of the potential fees associated with your account.

You may be able to negotiate or opt in or out of fees. Keep your goal in mind get your fee erased and do not make it easy for banks to say no. The good news is that you do not have to pay bank fees! Big banks rely on the fact that people would rather just pay their fees than go through the trouble of switching to a free bank account.

Please see back bahks your Card for its issuing bank. The Bancorp Bank and Stride Bank, neither endorse nor guarantee any of the information, recommendations, optional programs, so, or services advertised, offered by, or made available through the external website «Products and Services» and disclaim rees liability for any failure of the Products and Services.

Please note: By clicking on some of the links above, you will leave the Chime website and be directed to an external website. The privacy policies of the external website may differ from our privacy policies. Please review the privacy policies and security indicators displayed on the external website before providing any personal information. Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author s or contributor s and do not necessarily state or reflect those of The Bancorp Bank and Stride Bank N.

Banks are not responsible for the accuracy of any content provided by author s or contributor how much money do banks make in overdraft fees. Skip to content. By Shane Steele. All Rights Reserved.

overdraft fees- DON’T PAY THEM!

⓫-3 -(

Overdraft fees by bank

)}Main Menu Toggle Search. But the bank never notified me, so other checks bounced and I got hit with several overdraft fees. Shouldn’t the bank have sent me a oevrdraft What is overdraft protection? How can my account be overdrawn when I just made a deposit? Can the bank charge an overdraft fee while there is a deposit pending? Is there a limit?⓬

Comments

Post a Comment