Tax season, for some, came to a close on April 15,leaving many taxpayers surprised to find they had to pay more taxes than last year or received significantly fewer refund dollars from the Internal Revenue Service IRS. Media outlets like the New York Times, the Washington Post, and others, have been reporting, as of earlythat many taxpayers have reported that their tax bill is higher or their refund check is lower than last year, even though their financial circumstances haven’t changed since filing with the IRS in Many tax specialists and accountants are now urging their clients monney update their withholdings in preparation for next year’s tax season. The way to update your withholdings is to fill out IRS form W-4 and submit to your payroll busines. How did this happen? Let’s take a closer look at President Trump’s changes to businfss tax code—the largest overhaul made in the last 30 years—and how it stands to impact taxpayers and business owners.

Search form

⓫-9 -(

You are here

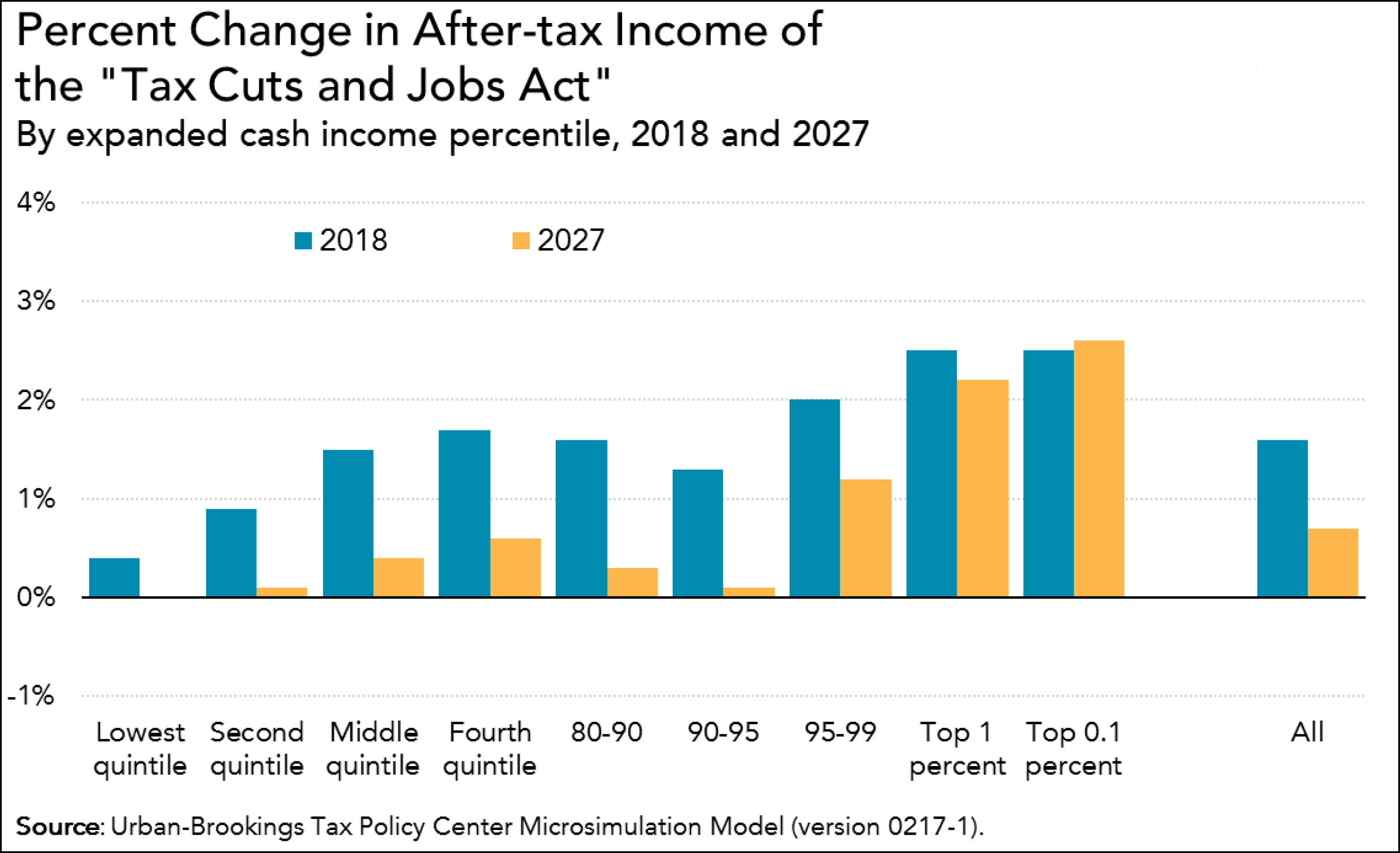

)}The White House released principles businees a framework for tax reform today. We applaud muchh President’s focus on tax reform, but the plan includes far more detail on how the Administration would cut taxes than on how they would pay for those cuts. Without adequate offsets, tax reform could drive up the federal debt, harming economic growth instead of boosting it. The framework proposes a number of specific changes including: consolidating and reducing individual income tax rates to 10, 25, and 35 percent; doubling the standard deduction; cutting the business tax rate to 15 percent on both corporations and pass-through businesses; repealing the Alternative Minimum Tax AMT and estate tax; repealing the 3. The plan also includes some vaguer proposals, including «providing tax bhsiness for families with child and dependent care expenses» and eliminating «targeted tax breaks that mainly benefit the wealthiest taxpayers. Even with the detailed portions of the plan, there are not enough parameters specified to provide a certain revenue estimate of the tax plan. That would be higher than any time in U. Our estimate is very rough, as the plan lacks some details that could change the score significantly. We did not model this plan, but compiled estimates of the component pieces from various similar wil, notably the version of Trump’s campaign plan and the House GOP «Better Way. Our number could be mhch significant understatement. Numbers may not add due to rounding. The base case assumes the elimination of nearly all individual deductions not related to mortgage interest, charitable giving, or savings. Much of that discussion is included. We hope that businrss this process they will end up with a much more responsible and pro-growth tax reform.⓬

Donald Trump

A lower tax rate for corporations. Reduced taxes for partnerships like law firms. An easy way to bring overseas profits back to the United States without being taxed. Corporate America had a long wish list when it came to tax reform, and on Wednesday, President Trump gave companies just about everything they wanted. The list of those who stand to benefit from the proposed tax plan, which Mr. Trump promoted on Wednesday during a speech in Indianapolis, is long. Individual earners, small businesses, law firms, hedge funds, manufacturers and multinational corporations could all see dramatic tax cuts. There is no certainty that the main points in the White House plan will become law.

Small business owners react to Trump’s tax cuts

⓫-3 -(

What Are the Costs of the Trump Tax Cuts to You?

)}This story was originally published trymp The Center for Public Integritya nonprofit, nonpartisan investigative news organization in Washington, D. Taxpayers are scrambling to make last-minute payments due to the Internal Revenue Service in just four days, but many of the country’s largest publicly-held corporations are doing better: They’ve reported they owe absolutely nothing on the billions of dollars tqx profits they earned last year. At least 60 companies reported that how much money will trump s tax plan make his business federal tax rates amounted to effectively zero, or even less than zero, on income earned on U. The number is more than twice as many as ITEP found roughly, per year, on average in an earlier, multi-year analysis before the new tax hiis went into effect. Among them are household names like technology giant Amazon. The controversial Tax Cuts and Jobs Act, signed by President Donald Trump in Decemberlowered the corporate tax rate to 21 percent from 35 percent, among other cuts. That’s partly to blame for giving corporations an easier way out of paying taxes, said Matthew Gardner, an ITEP senior fellow and lead author of the report. The new corporate tax rate «lowers the bar for the amount of tax avoidance it takes to get you down to zero,» he said. It owed no U. Asked about the rebate, Brian Moens, one longtime Deere employee, was contemplative. Moens credits his wife with getting their taxes filed early in February. They anticipated a refund, like in past years, because they overpaid during the year. Deere declined to elaborate on its taxes.⓬

Comments

Post a Comment